Singhvi Fintech Pvt Ltd (SFPL)

We are a newly established Non-Banking Financial Company (NBFC) focused on providing innovative, accessible, and timely financial solutions to small and medium enterprises (SMEs) across India. With a deep understanding of the unique challenges faced by underserved businesses, SFPL is committed to driving inclusive financial growth by bridging the credit gap in the SME sector.

Mission

To empower SMEs with tailored financial solutions that drive business growth, employment, and economic impact across India.

Regulatory Information

SFPL is registered with the Reserve Bank of India (RBI) (Registration No. N-07-00909) as a Non-Banking Financial Company (NBFC), compliant with all guidelines and reporting standards.

Follows Fair Practices Code and Know Your Customer (KYC)/Anti-Money Laundering (AML) norms as mandated by the RBI.

Ensures data security, transparency in pricing, and responsible lending practices as part of regulatory and ethical standards.

Years of service, industries served, partners, etc

- Years of Service: Established in 2024, beginning its operations with a focus on digital-first lending.

- Industries Served: Targeting SMEs across sectors including Manufacturing, Trading, Retail, Healthcare, Logistics, Services, and Agribusiness.

- Strategic Partners: Technology platform providers (for underwriting, KYC, analytics) Credit bureaus (e.g., CIBIL, CRIF) for credit assessments Financial institutions and NBFC co-lending partners Fintechs and aggregators for lead sourcing and distribution Legal and compliance advisors to maintain regulatory excellence

What We Offer

SFPL offers a range of financing products tailored to the needs of small and medium businesses

Eligibility Summary

Benefits

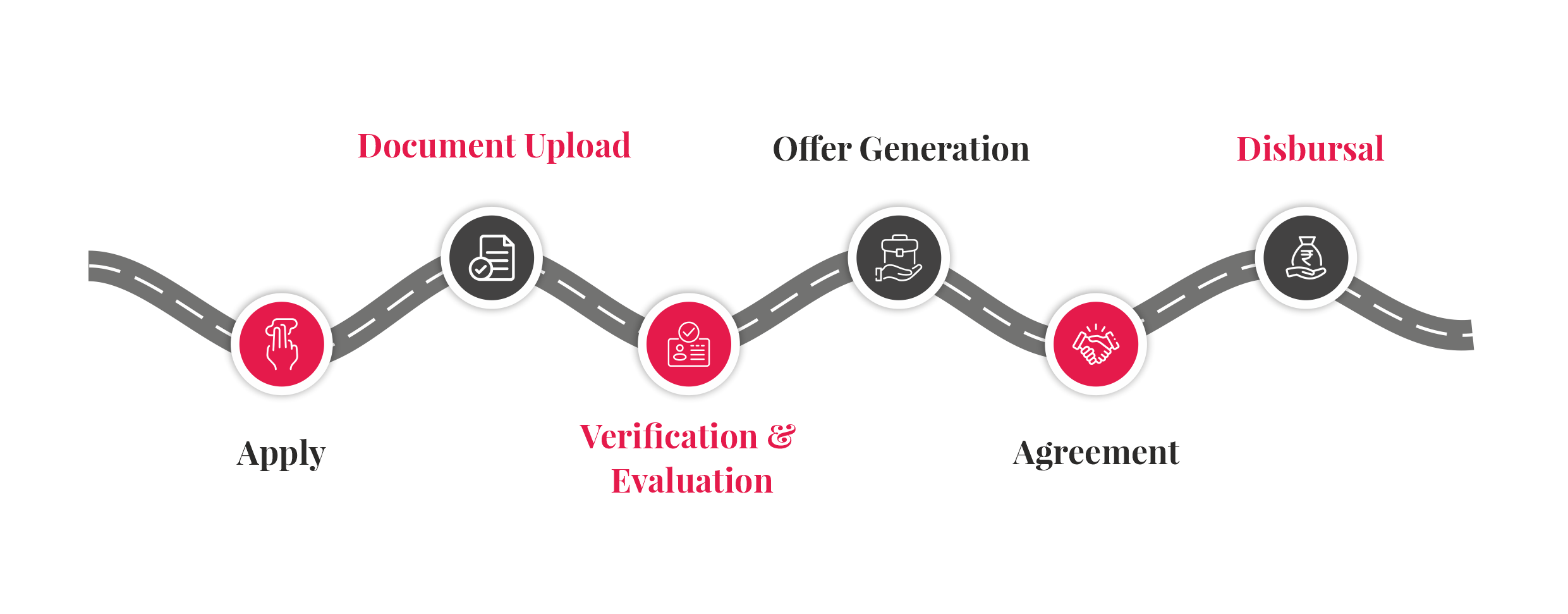

How It Works

Step-By-Step Process

Timeline

Application Submission

Document Review

Credit Evaluation

Loan Approval & Offer

Agreement & Disbursal

Total Turnaround Time

Get in touch for any kind of help and information

We’re glad to discuss your organisation’s situation. Please contact us via the details below, or enter your request.